Money blog: ‘They called me Tit Rat’: Why are there so few women in top kitchens?

Along with each sale of goods, there is a related cost of goods entry that must be booked to record the inventory being sold. When the inventory is delivered to the customer, it is taken off the books for the cost originally paid as a credit to inventory. The Cost of Goods Sold account, and expense account, is debited for the same cost as the inventory was recorded at, as shown below.

Our Team Will Connect You With a Vetted, Trusted Professional

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Format and posting of cash receipts journal

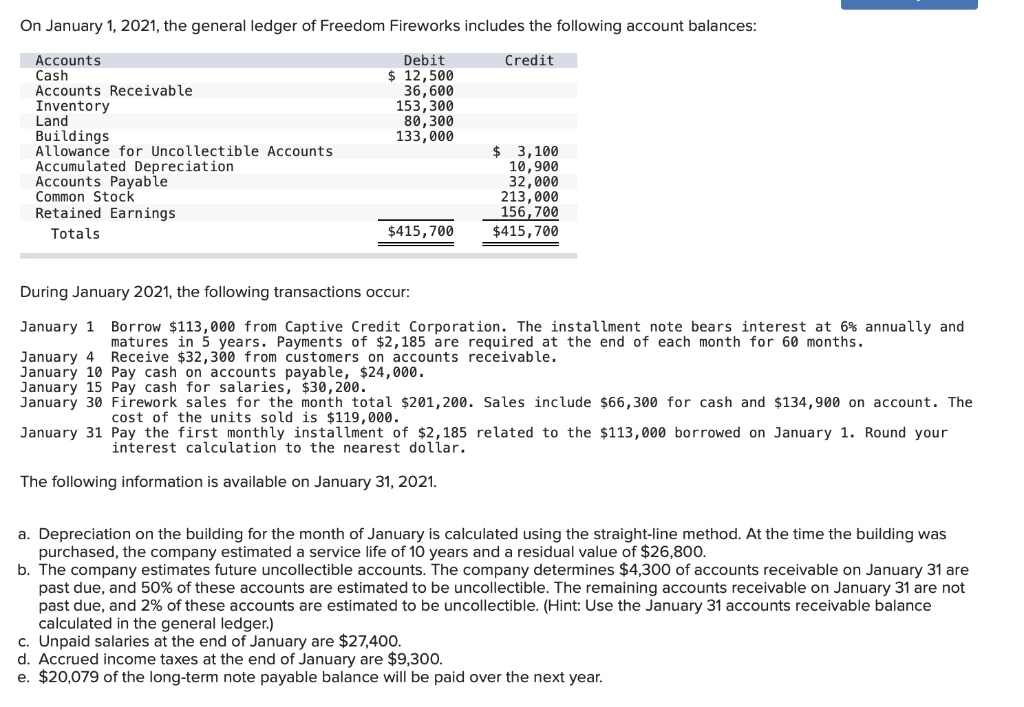

Businesses track their revenue closely because it can be a good indicator of overall business health. Revenue is usually recorded when the service is provided, rather than when the payment is received. This is because businesses typically provide services on credit, and they want to record the revenue as soon as the service is provided. This ensures that they are able to track their revenue accurately and it is matching with the cost spent. The total from each column in a cash receipts journal is posted to the appropriate general ledger account.

- This process can become complicated if you have individual invoices or bookkeeping entries for a good or service sold to each customer, and if you then make lump-sum deposits of cash to your bank.

- Assuming your business sells inventory to someone for the sales price of $1,000 then you would need to record this entry.

- You can also contact us if you wish to submit your writing, cartoons, jokes, etc. and we will consider posting them to share with the world!

- As soon as the products have been manufactured and delivered to the customer, the revenue from the sale can be recognized by the business.

Cash Advance Received From Customer Journal Entry

To keep your books accurate, you need to have a cash receipts procedure in place. Your cash receipts process will help you organize your total cash receipts, avoid accounting errors, and ensure you record transactions correctly. Suppose for example, the business provides services to a customer and receives immediate payment for cash for the amount of 500, then the journal entries will be as follows. When you charge a customer for the services you perform how to calculate the right of use asset amortization and lease expense under asc 842 for them, you can turn the retainer or deposit you previously received into credit on an invoice and receive it like a payment. The risk of clients not paying their accounts receivable amounts is relatively low, as it is usually a legally binding obligation (provided your contracts and payment terms are structured appropriately). If the client becomes insolvent or is otherwise unable to pay off the debt, you then consider the account as a bad asset.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. A check is placed under the total of this column as this total is net posted. Speaking at the time, Morrisons told Sky News it made the majority of its bread and rolls from scratch in-store.

How are the totals from the different columns in a cash receipts journal posted to general ledger accounts?

This type of situation might occur for example when a business demands cash in advance to pay for materials on a large or bespoke order or as a rental deposit on a property. Whenever a cash receipt is generated and you have received one of these three forms of payment, you debit your cash account in your cash receipts journal and credit your sales on your profit and loss statement. Accounts receivable are amounts owed to a business by customers for credit sales invoiced to them on account.

As the goods or services have not been delivered, the revenue from the sale has not been earned, and the cash receipt must be recorded as a liability in the balance sheet. If delivery is expected within the next year, then the liability will be shown as a current liability, if not, then it should be shown as a long-term liability in the balance sheet. Assuming your business sells inventory to someone for the sales price of $1,000 then you would need to record this entry. Any time cash is received, it would be a debit to cash, as this is the normal balance of the account. The normal balance of Sales is a credit, when we credit that account it also increases. Making accounting journal entries for cash are fundamental for a business.

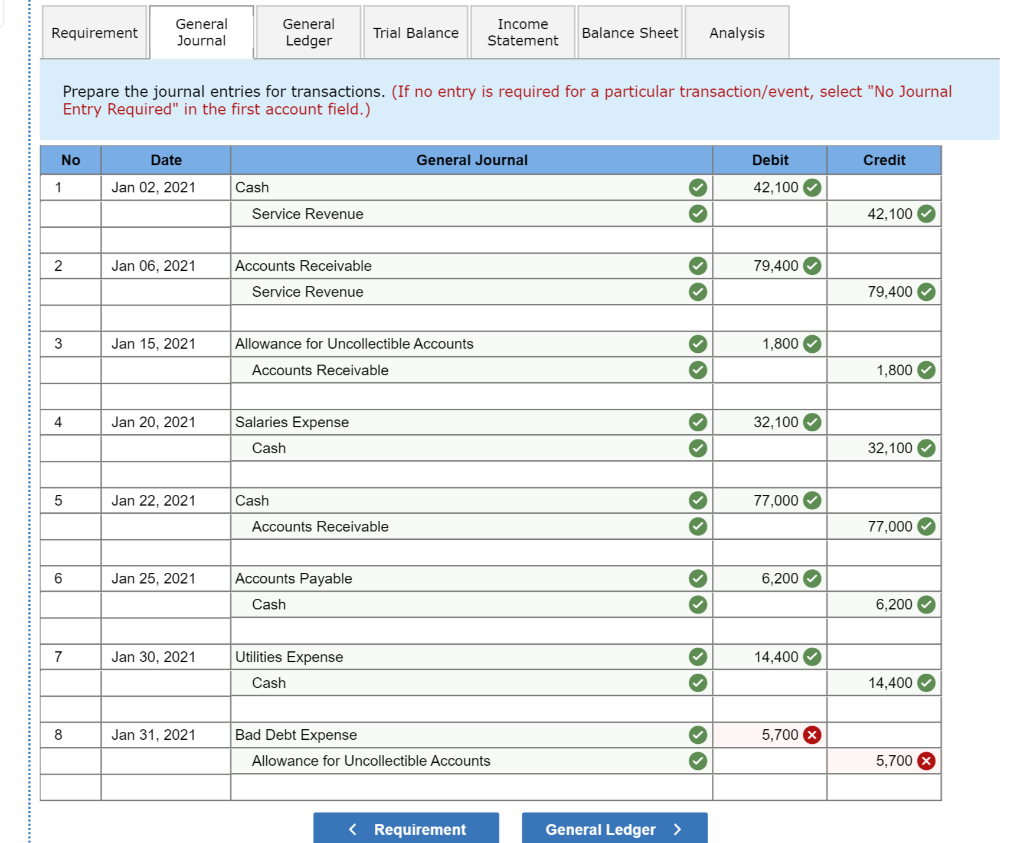

The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts. The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used. Keeping track of your business’s cash receipts in a timely manner is necessary for efficient financial management.

Keep in mind, the cash receipt process varies from business to business. You can tweak the above steps to better fit the workflow of your company. If you accept checks, be sure to also include the check number with the sales receipt. To make sure your books are as accurate as possible, make sure you organize business receipts using a storage system (e.g., filing cabinets or computer).

Without an invoice, company can still record revenue by using the accrued method. However, if the company provides service and receives cash at the same time, the company needs to record cash and sales revenue. It will increase the cash balance on the balance sheet and revenue on the income statement. As with other journals, the cash receipts journal is posted in two stages. Any entries in the accounts receivable column should be posted to the subsidiary accounts receivable ledger on a daily basis. Because you have already received the cash at the point of sale, you can record it in your books.