How to calculate days payable outstanding & optimize cashflow

Additional informationDuring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss. Cash Flow from operating activities (CFO) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational capabilities. Interest paid or received will find a place in the profit and loss account and cause the movement of cash.

How comfortable are you with investing?

Revenue and expense items that arenot related to those current asset and liability accounts would notneed an adjustment. The amount of cash received from customers is calculated by adjusting total sales shown in the income statement for the movement in the customer accounts receivable balances (AR) shown in the balance sheet. The procedure or formula that we have used to convert accrual-based operating expenses to cash paid for operating expenses can also be used to convert accrual-based interest expenses to cash paid for interest. According to this procedure, a decrease in interest payable is added to and an increase in interest payable is deducted from the accrual-based interest expense.

Direct Method

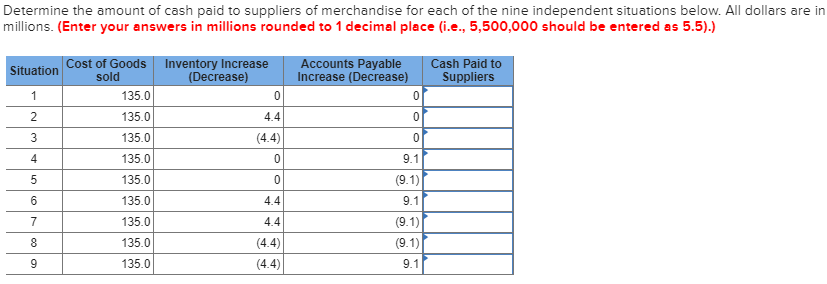

Operating cash flow is the cash generated from a company’s normal business operations, which includes cash receipts from customers and cash paid to suppliers. Once all the cash inflows and outflows from operating activities are calculated, they are added together in the operating accounting examples of long section of the cash flow statement to obtain the net cash flow from operating activities. Although it has its disadvantages, the statement of cash flows direct method reports the direct sources of cash receipts and payments, which can be helpful to investors and creditors.

- Let’s say your company has an Accounts Payable balance of $200,000, a COGS of $1,000,000, and you’re analyzing over a year (365 days).

- Answer (a) direct methodThe direct method is relatively straightforward in that all the data are cash flows so it is really just a case of listing the receipts as positive and the payments as negative.

- Under the direct method, the information contained in the company’s accounting records is used to calculate the net CFO.

- The statement of cash flows direct method uses actual cash inflows and outflows from the company’s operations, instead of modifying the operating section from accrual accounting to a cash basis.

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- Both the interest and income tax expenses should be adjusted in the same manner as any other expense (as demonstrated for the wages in the calculations above).

How to calculate days payable outstanding & optimize cashflow

Answer (a) direct methodThe direct method is relatively straightforward in that all the data are cash flows so it is really just a case of listing the receipts as positive and the payments as negative. There are two different ways of starting the cash flow statement, as IAS 7, Statement of Cash Flows permits using either the ‘direct’ or ‘indirect’ method for operating activities. The investing and financing activities are reported exactly the same on both reports. The next step is to convert the purchases figure to a cash paid basis by adjusting for the movement on accounts payable during the year. The amounts of interest and dividend received are added together and reported as a single line item in the statement of cash flows.

During the year the tax charged in the statement of profit or loss was $100. The following example shows the format and calculation of cash flows from operating activities using direct method. To demonstrate this the information used in the direct method cash flow example above is set out below in the indirect cash flow statement format. The net sales figure is available from the income statement, and the increase or decrease in accounts receivable can be determined using the beginning and ending balances of the accounts receivable. Solution Here we can take the opening balance of PPE and reconcile it to the closing balance by adjusting it for the changes that have arisen in the period that are not cash flows.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Ideally, you want a short CCC, meaning you collect payments quickly and delay outflows without jeopardizing supplier relationships. This article will guide you on how to figure out DPO, including the calculation formula and how it reflects your business payment practices. A decrease in creditors or bills payable will reduce cash, whereas an increase in creditors and bills payable will increase cash.

For example, when the opening balance of an asset, liability or equity item is reconciled to its closing balance using information from the statement of profit or loss and/or additional notes, the balancing figure is usually the cash flow. For example, a company using accrual accounting will report sales revenue on the income statement in the current period even if the sale was made on credit and cash has not yet been received from the customer. The difficulty and time required to list all the cash disbursements and receipts—required for the direct method—makes the indirect method a preferred and more commonly used practice. Since most companies use the accrual method of accounting, business activities are recorded on the balance sheet and income statement consistent with this method. The cash flow statement’s direct method takes the actual cash inflows and outflows to determine the changes in cash over the period.

As noted above, IAS 7 permits two different ways of reporting cash flows from operating activities – the direct method and the indirect method. Given that it is only a book entry, depreciation does not cause any cash movement and, hence, it should be added back to net profit when calculating cash flow from operating activities. Keep in mind that these formulas only work if accounts receivable is only used for credit sales and accounts payable is only used for credit account purchases. Depreciation is a non-cash item in that it is an accounting entry and does not involve the movement of cash, as such it can be excluded from the direct method cash flow statement. Investing activities cash flows are those that relate to non-current assets, including investments.